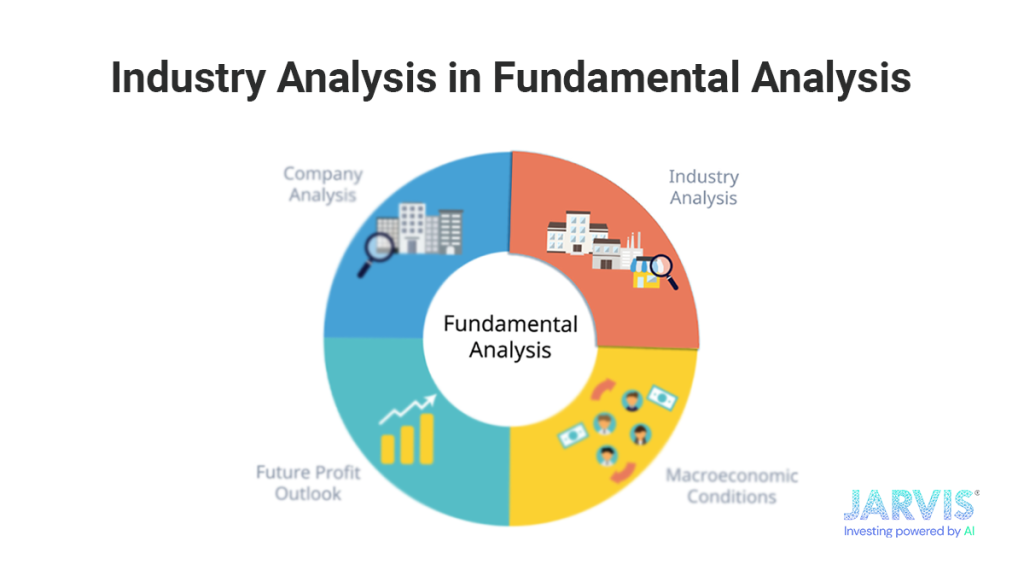

To start investing in the stock market and find the best long-term stocks, you must understand fundamental analysis. It is a method used by investors to evaluate the intrinsic value of securities such as stocks. The approach involves examining related economic, financial, and other qualitative and quantitative factors to determine the underlying value and assets’ potential future performance. Today, we will check the role of industry analysis in fundamental analysis.

The Importance of Industry Analysis for picking stocks

Industry analysis offers a macro-level perspective that is essential for evaluating individual companies within a sector. Here’s why it’s so important:

- Mapping the Competitive Landscape

- Identify industry leaders, challengers, and niche players

- Assess competition intensity and barriers to entry/exit

- Understanding Industry Life Cycles

- Determine industry stages (emerging, growth, mature, decline)

- Evaluate growth prospects and investment opportunities

- Benchmarking Performance

- Compare company performance against industry averages

- Identify relative strengths and weaknesses

How does industry analysis help investors?

By understanding the industry, investors can:

- Identify attractive industries: Focus on industries with strong growth prospects and favorable competitive dynamics.

- Select strong companies: Choose companies with competitive advantages and superior financial performance within the industry.

- Assess valuation: Determine if a company is overvalued or undervalued relative to its industry peers.

- Manage risk: Identify industries and companies susceptible to economic downturns or other challenges.

Key Questions for Effective Industry Analysis

To conduct a thorough industry analysis, consider the following:

- Industry Definition: What is the precise industry in which the company operates?

- Economic Impact: How susceptible is the industry to economic cycles?

- Market Potential: What is the industry’s size and growth prospects?

- Historical Performance: How has the industry performed, and what were the key drivers?

- Competitive Dynamics: What is the level of competition, and how does it affect pricing power?

- Secular Trends: Are there long-term trends causing value migration within the industry?

- Regulatory Environment: What regulatory headwinds or tailwinds are affecting the industry?

Challenges in Defining Industries

Accurately defining an industry can be complex. Standard classification systems like NIC, GICS, or NAICS may not always capture the nuances of modern business landscapes. For example:

- PVR Limited: PVR Cinemas faces competition from satellite channels and Over the Top (OTT) platforms like Netflix and Hotstar, as well as live theatres, live performances, and sporting leagues. Analyzing PVR Cinemas within a narrow industry definition, such as cinema exhibitors, risks overlooking broader competitors. Conversely, defining it within the larger entertainment media or Out of Home (OOH) entertainment industries presents another challenge, as each segment has unique characteristics and isn’t strictly comparable. This complexity forces analysts to carefully consider PVR Cinemas’ position within the broader media and entertainment landscape.

- Camera Manufacturing: Camera manufacturing is another example that shows the challenges in defining an industry. How do you account for competition from smartphone cameras? A couple of decades ago, cameras were standalone products, but the rise of mobile phones with built-in cameras led to a decline in entry-level digital camera sales. Today, advanced mobile phones are even challenging mid-tier cameras. Defining cameras as a standalone industry could cause analysts to overlook significant competition from mobile phones.

Understanding the key drivers behind a business is crucial for analysts when categorizing companies within industry groups. For instance, if PVR Limited’s success is primarily influenced by people’s desire to spend time outside their homes, it should be classified under the ‘out-of-home entertainment industry.’ Conversely, if PVR Limited’s growth hinges on consumers’ demand for movie content, it aligns more with the ‘entertainment media sector.’ Accurate classification helps analysts make informed investment decisions, ensuring better portfolio management.

To overcome these challenges, analysts should:

- Consider factors that drive the business

- Classify companies based on common driving factors

- Use flexible classification systems like GICS, which offers a hierarchical structure with sectors, industry groups, industries, and sub-industries

Conclusion

Industry analysis is a powerful tool in fundamental analysis, helping investors make more informed decisions by understanding the competitive landscape, industry trends, and economic factors that impact company performance. By mastering this aspect of fundamental analysis, you’ll be better equipped to identify promising long term stocks and build a robust investment portfolio.

Remember, successful investing requires continuous learning and adaptation. Stay informed about industry developments, keep refining your analysis techniques, and always consider the broader context when evaluating individual stocks. With a solid understanding of industry dynamics, you’ll be well-positioned to navigate the complexities of the stock market and achieve your investment goals. To know more about how to evaluate and pick stocks for long term through the industry analysis in fundamental analysis, Visit Jarvis ai.