SEBI Registered Investment Advisor

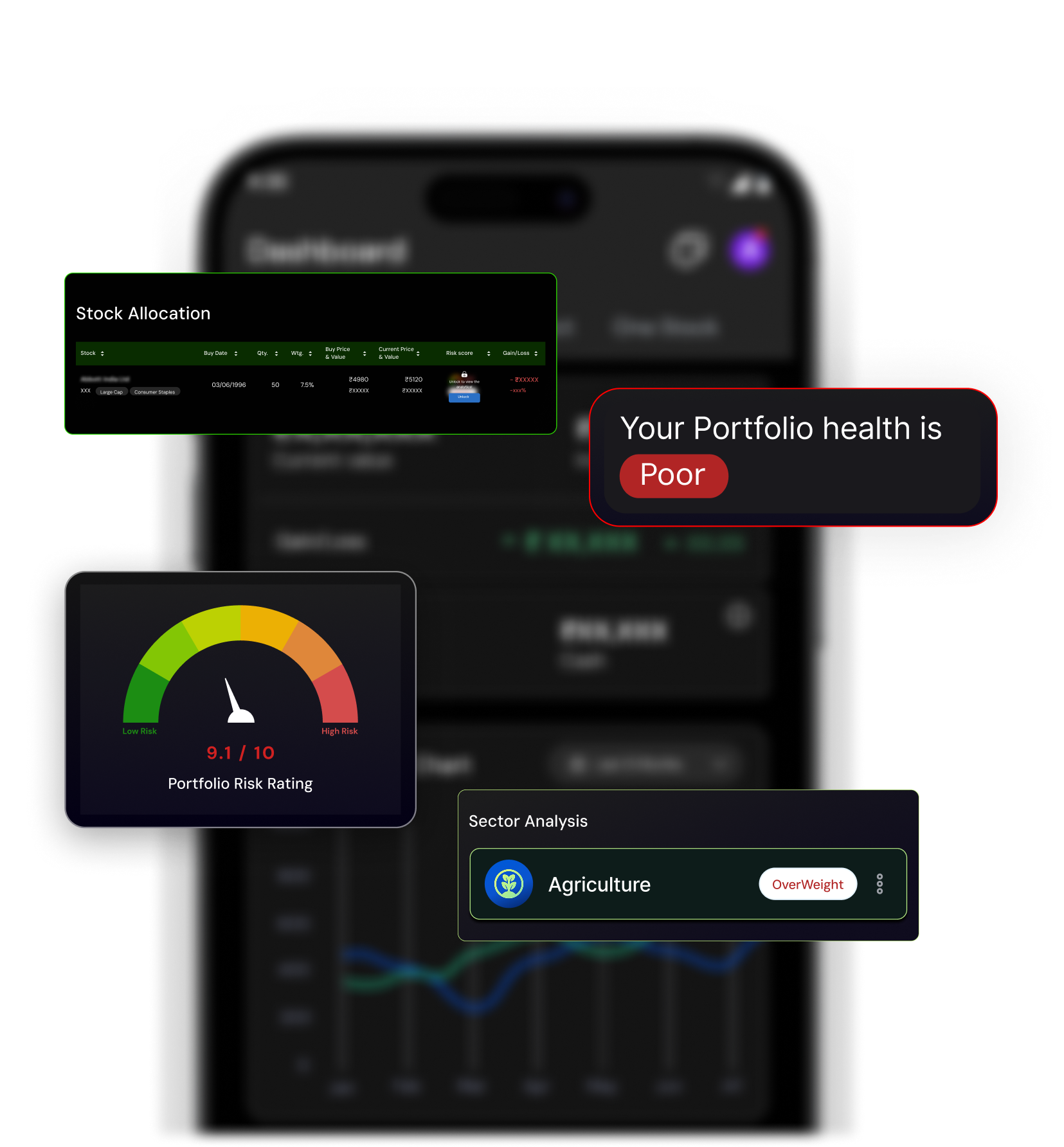

AI Powered

Stock Recommendations for

Long Term & Short Term Investments

Invest • Protect • Grow

Start Investing with AI todayAssets under advisory

Countries

Years of Legacy in India

New Customers (Enquiry): +91 7208809638

New Customers (Enquiry): +91 7208809638