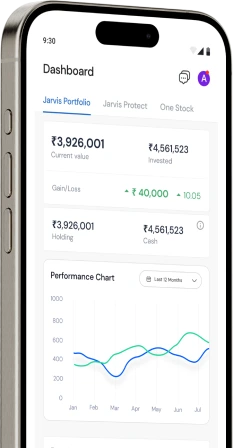

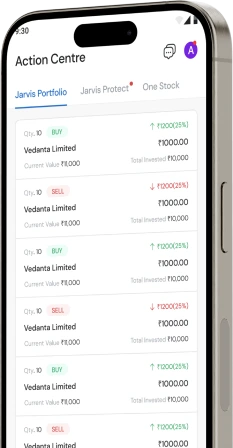

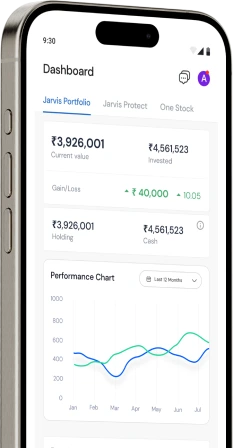

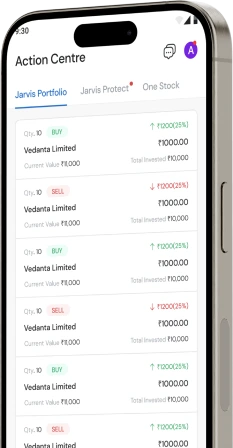

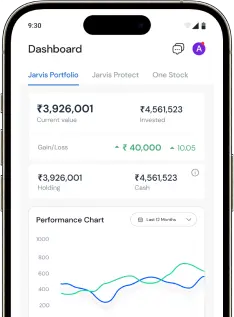

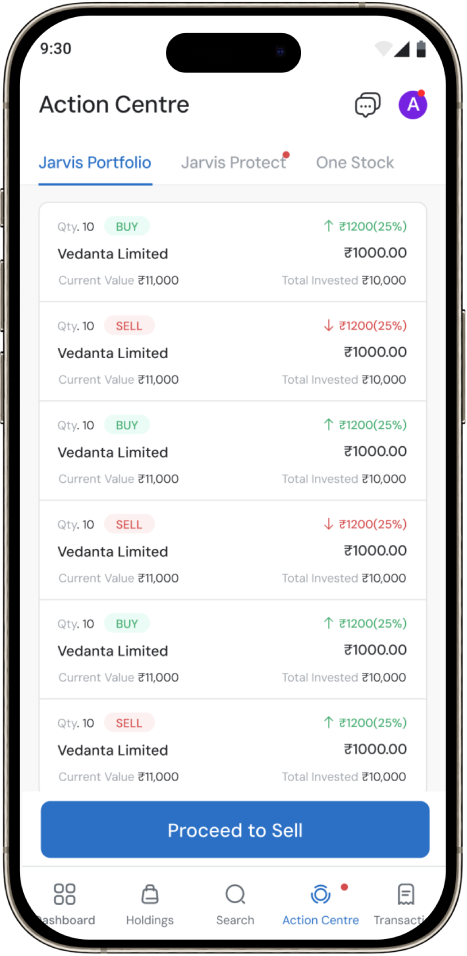

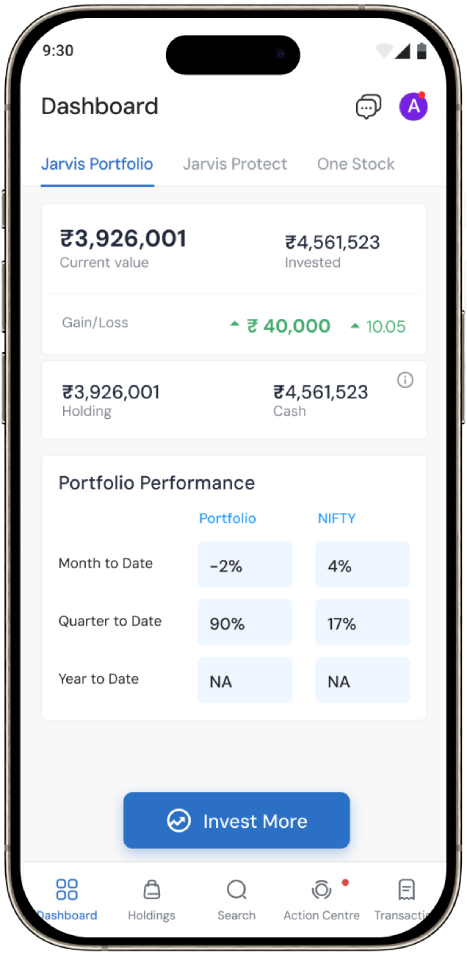

Jarvis Portfolio

Suitable For Long-Term

For You And Manage It On Your Behalf

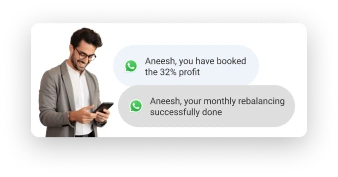

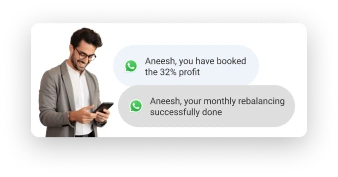

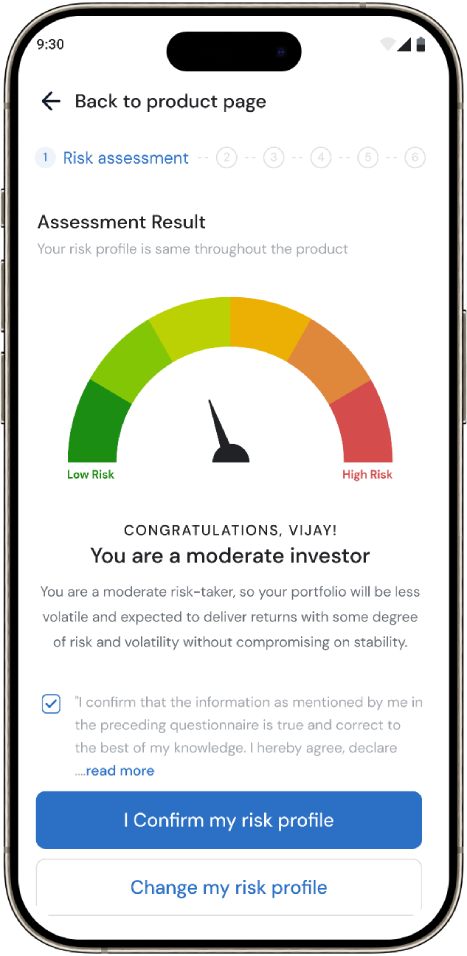

At JARVIS, we understand that no two investors are alike.

Your investment style, goals, and risk tolerance

are unique, so your portfolio should be too.

Unlike traditional services with one-size-fits-all models, JARVIS

uses advanced AI to create a

personalized investment experience

just for you.

It’s not just about investing it’s about investing your way

—with the power of AI.

India

7th Floor Dheeraj Kawal, Lal Bahadur Shastri Rd, Vikhroli West, Mumbai, Maharashtra 400079

customersupport@jarvisinvest.com

Mon - Sat | 10:00 AM - 07:00 PM (Sunday Closed)

INA 000013235

INA 000013235

INH 000018762

INH 000018762