Most Searched Questions

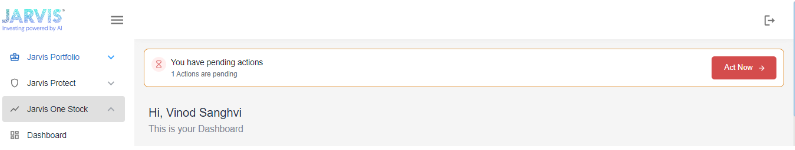

Step 2 : You will be redirected to pending tab action for which the action is pending for the product on which action is required to be taken.

Step 2 : You will be redirected to pending tab action for which the action is pending for the product on which action is required to be taken.

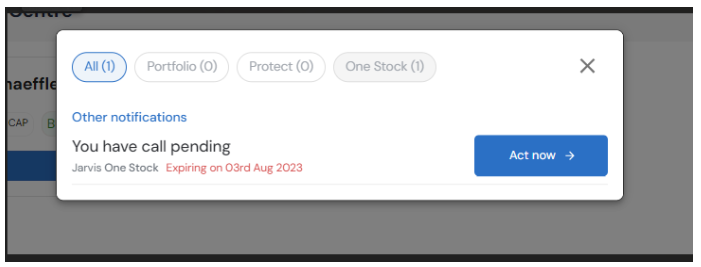

Step 3 : There are two option for the customer to update the suggested trade

(A) MANUAL UPDATE

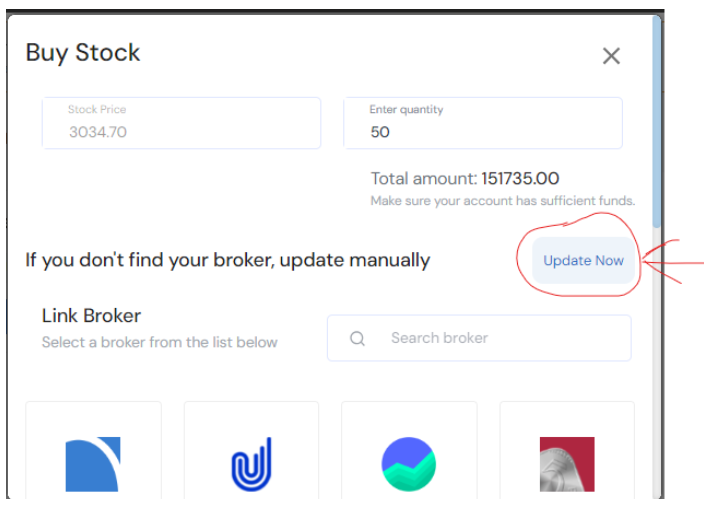

1. Customer has the option to UPDATE NOW this option, you can select this option if you have manually executed the stock Buy/Sell directly from the broker

Step 3 : There are two option for the customer to update the suggested trade

(A) MANUAL UPDATE

1. Customer has the option to UPDATE NOW this option, you can select this option if you have manually executed the stock Buy/Sell directly from the broker

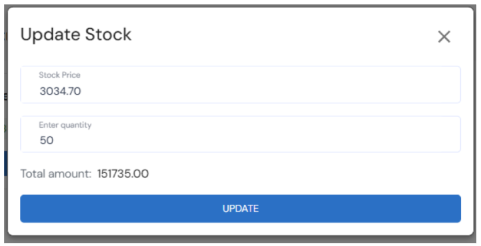

2. This will provide you an option to update the price & amount to update in the Jarvis system so that your dashboard will be updated & your performance will be monitored on the Jarvis application.

2. This will provide you an option to update the price & amount to update in the Jarvis system so that your dashboard will be updated & your performance will be monitored on the Jarvis application.

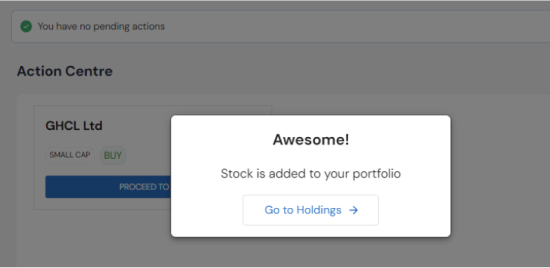

Step 4 : Final confirmation, you can view the stock added in your holdings tab in your dashboard.

Step 4 : Final confirmation, you can view the stock added in your holdings tab in your dashboard.

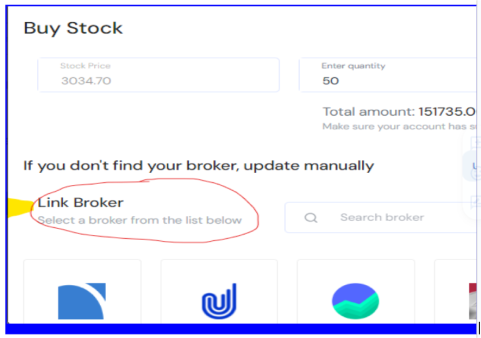

(B) LINKING BROKER

1. Select the Broker within the listed broker option if available please execute the BUY/SELL trades, this will automatically update the trades in Jarvis after your execution from your broker.

(B) LINKING BROKER

1. Select the Broker within the listed broker option if available please execute the BUY/SELL trades, this will automatically update the trades in Jarvis after your execution from your broker.

2. Once done your stocks will be available in your holdings.

2. Once done your stocks will be available in your holdings.

One stock alert a week before market hours

One Stock Plus-Three stock* alerts a week (Monday Wednesday & Friday)Before market hours

One Stock Premium-Five stock* alerts a week (All trading days)Before market hours

Note:*Stocks will be recommended based on prevailing market conditions. There might be days where you might not receive any recommendation, if JARVIS is unable to identify suitable stock based on your risk profile.

New Customers (Enquiry): +91 7208809638

New Customers (Enquiry): +91 7208809638

INA 000013235

INA 000013235