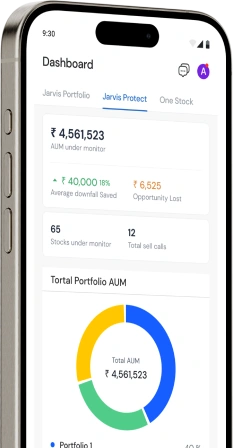

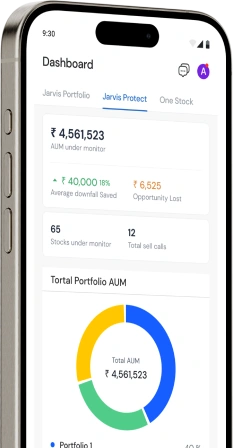

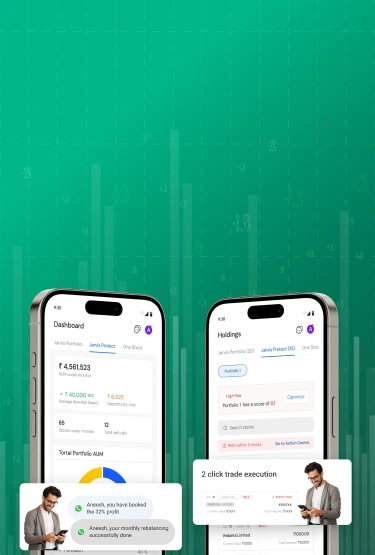

Jarvis Protect

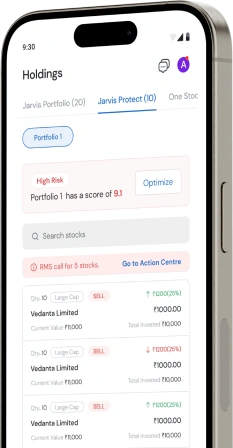

Let the AI-powered Jarvis Identify Red

Flags in portfolio

Most investors struggle with knowing when to exit stocks, leading

to underperforming portfolios.

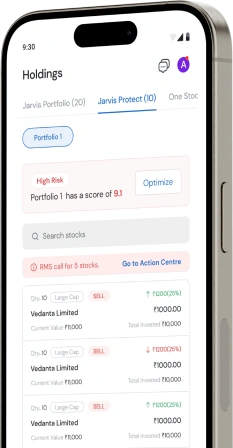

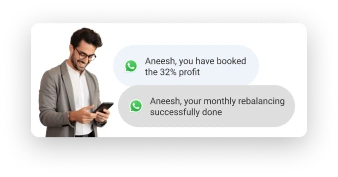

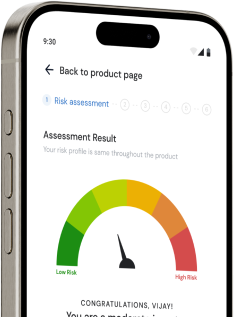

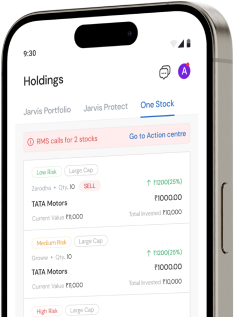

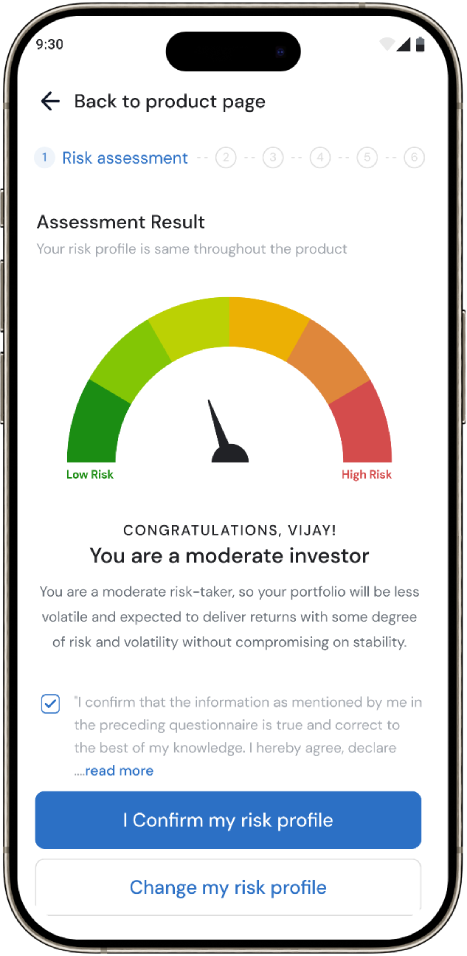

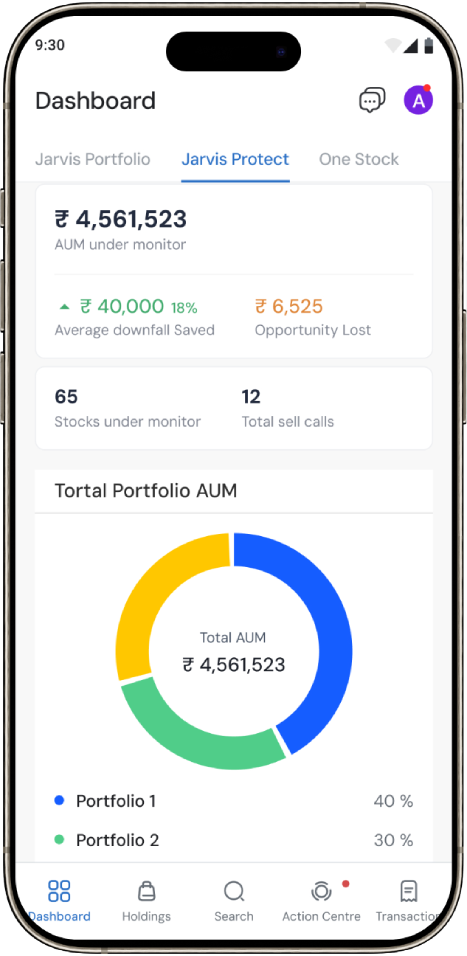

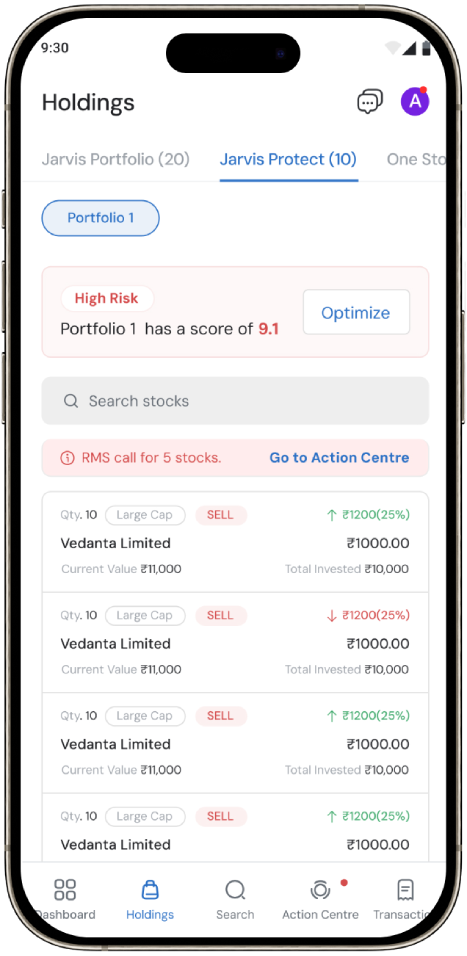

Jarvis Protect is designed to assist by providing timely alerts to

help you book profits or cut losses,

ensuring your investment

decisions align with your risk appetite and time horizon.

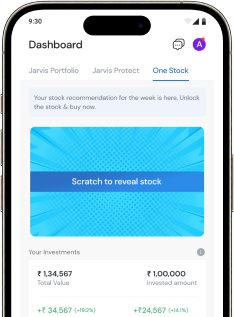

Let Jarvis guide your exit strategy while you focus on building

your portfolio

Fantastic platform! The trading experience has been smooth, and I’m seeing excellent returns on my investments.

I love how simple the platform is to use. My investment portfolio has grown significantly thanks to their guidance.

This app has been very helpful in navigating the stock market. The suggestions are spot on!

The trading platform is user-friendly, and I’ve seen great returns in just a few months of using it.

The stock picks are fantastic, and my portfolio has grown consistently. With the right guidance, I am confident in my investments.

Great stock recommendations and a very easy-to-use app. A beginner-friendly platform for anyone new to investing.

Excellent services and spot-on stock recommendations. Made solid profits, and I am a regular user now.

I’ve been trading for over a decade, and this platform is by far the most reliable. Definitely worth the investment.

I’ve been using this app for a year now, and it has been great for stock picking and booking profits.

A solid app with great suggestions. I’ve been able to manage my investments and make good profits.

This app offers timely suggestions, and the user interface is great for traders at all levels.

I've been using this app for 6 months. The stock recommendations have been excellent, and I’ve already reached my financial goals.

This app has been a huge help. The stock picks are solid, and I’ve been able to book profits effectively.

I've been using this app for a while now, and the experience has been great. The stock picks are helpful for profit booking.

Started using the app recently. The returns have been good so far, but the navigation could be improved.

The stock suggestions have been great, and I’m seeing returns. However, there’s room for improvement in app navigation.

Using the app for a couple of months. The returns are good, and it’s easy to use, but it could benefit from more detailed market analysis.

Amazing experience! The app provides solid recommendations, and I’ve been able to secure my investments with their timely suggestions.

I’ve been using this app for 4 months, and the experience has been great. It’s perfect for trading and making consistent profits.

Highly recommended! This app makes frequent profit booking suggestions, ensuring you always make the most out of your investments.

Excellent app! I’ve been using it for a year now, and I’ve seen great returns on my investments. Consistently helps me make the right decisions.

Good Service! Good platform for trading and investing. Profitable stocks and investments.

It's very easy to use, and the amount which I have invested I am getting good returns.

Very nice App n suggestions.

Good service ....good platform for trading.

Good stock picks has helped me grow my portfolio consistently. While there are risks, staying informed and choosing the right stocks have definitely paid off.

Good stock recommendation. Made the good profits. Simple app can be used by beginners, good platform for invest.

Good services and stock recommendation. Made a good profit.

Awesome! I have been trading in financial market for last 7 years and traded with almost all major/discount broker in the market but I can say with 100% responsibility that jarvisinvest...

I am doing stock market investing since 1 year, this app helps me a lot for stock picking and stock selling this app gives good suggestion for profit booking.

Good app, good suggestion, good profit booking.

Nice app with nice guidance and profit booking.

I've been using the app for 8 months now. The stock recommendations have been excellent, and I've made good profits. It has helped me achieve my financial goals.

Good app which gives good suggestions and also guide for profit booking.

I am using this app since 3 months. I got nice experience with this app. Stock picks is good and suggest profit booking whenever needed.

I recently started investing from this app. Have seen good returns so far. The app can be little hard to navigate but the relationship managers can help.

I’ve been investing with Jarvis for a few months now, and their stock recommendations have been solid, giving me great returns. The support has also been impressive, especially...

I am using this app since 2 months. I got very good returns with moderate profit booking.

It was a very nice experience to use this app. Also, timely profit booking suggestions are very good, which we can use to secure investment.

I have been using this app since 5 months and it was pretty good experience with this app. It is good for trading. And you get handsome profit booking.

This app is good for trading which suggest frequent profit booking.

This app is very good, and I was using this app since 1 year. We can get good return from this app.

Access India’s top broking platforms for a seamless execution experience.

Access India’s top broking platforms for a seamless execution experience.

India

7th Floor Dheeraj Kawal, Lal Bahadur Shastri Rd, Vikhroli West, Mumbai, Maharashtra 400079

customersupport@jarvisinvest.com

Mon - Sat | 10:00 AM - 07:00 PM (Sunday Closed)

INA 000013235

INA 000013235

INH 000018762

INH 000018762